Introduction to Forex Hedging

Key Takeaways

- Forex hedging mitigates risks associated with volatile currency markets.

- It is a strategy for protecting investments while ensuring stable cash flows.

- Both individual traders and corporations utilize hedging for financial security.

- Popular instruments include spot contracts, forward contracts, and options.

- Understanding hedging can lead to better risk management and financial outcomes.

Table of contents

- 1. Diving into the Concept of Forex Hedging

- 2. Understanding the Dynamics of Hedging in Forex Trading

- 3. The Importance of Utilizing Hedging in Forex

- 4. An Overview of Popular Forex Hedging Strategies

- 5. Merits of Forex Hedging

- 6. Risks and Limitations of Hedging in Forex Trading

- 7. The Right Time to Implement a Hedging Strategy

- 8. Instruments and Tools for Successful Hedging

- 9. Real Life Instances of Successful Forex Hedging

- 10. Forex Hedging Best Practices

- Conclusion

Forex hedging is a vital method in risk management for mitigating potential losses in the exchange rates. It is a strategic move employed by both individual traders and multinational enterprises in the volatile forex market. With the constant fluctuations in the currency market, understanding what forex hedging is and how it can be utilized could be the key to navigating through the unpredictable world of forex trading. [Source: ShareIndia]

1. Diving into the Concept of Forex Hedging

What is Forex Hedging?

Forex Hedging is a strategic move where traders open multiple positions to offset potential losses from unexpected currency movements. This method acts as a safety net against any adverse fluctuations in the currency market, thereby mitigating the risks [Source] associated with forex trading. [Source: ShareIndia]

Goals Behind Employing Hedging in Forex Trading

Forex hedging is primarily used to safeguard investments from currency risks while simultaneously stabilizing profits and cash flows. It is thus crucial for multinational corporations to rely on hedging to maintain stable financial statements, free from the turbulence of extreme market volatilities. [Sources: ShareIndia], [Convera]

2. Understanding the Dynamics of Hedging in Forex Trading

How Does Forex Hedging Work?

In its working, forex hedging is straightforward. Traders take long and short positions in the market to counterbalance the loss incurred in one position with the gain from another. By doing so, forex hedging aims to neutralize the financial risks [Source] without focusing on generating profit. [Source: ShareIndia]

The Difference between Hedging and Speculative Trading

Unlike hedging, speculative trading focuses on profiting from currency fluctuations. The main agenda of hedging is to mitigate risks, aside from speculative trading that is driven by market movements and involves accepting potential risks [Source] for possible gains.

3. The Importance of Utilizing Hedging in Forex

Reducing Impact of Unfavorable Currency Movements

Hedging is crucial to reduce exposure to harmful currency movements, which can affect profits and trading margins. Employing hedging strategies ensures that traders and businesses can protect their financial interests, irrespective of the market’s motion. [Sources: Hedgebook], [GTreasury]

Enhancing Cash Flow Predictability

By stabilizing currencies against adverse movements, hedging enhances the predictability of future cash flows. Such predictability is beneficial to meet obligations, plan finances, and ensure operational stability. [Source: ShareIndia]

Creating a Stable Trading Environment

In the face of market volatility, hedging provides stability. It allows traders to navigate economic uncertainties [Source] with increased control, while also removing the constant worry of sudden market changes.

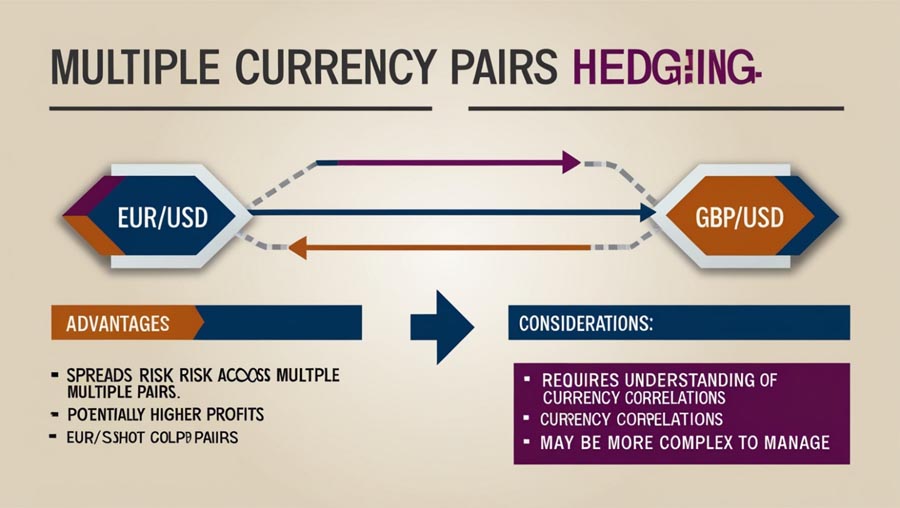

4. An Overview of Popular Forex Hedging Strategies

Spot Contracts and their Role in Hedging

Spot contracts, which involve immediate currency trading at current market rates, are vital tools to hedge against short term currency exposures. This strategy allows instantaneous mitigating of risks by locking in the current rates, thereby protecting against market turbulences of the short term.

Forward Contracts: A Glimpse

Forward contracts, which dictate the exchange of currency at predetermined rates on a future date, secure future transactions against potential currency valuation changes. Such contracts allow businesses to establish a strong financial setup by fixing future costs and revenues. [Source: ShareIndia]

The Flexibility of Options Contracts

Options contracts allow traders to buy or sell a currency at a predetermined rate within a specific timeframe, providing the flexibility and protection required to better handle market fluctuations.

The Value of Cross Currency Swaps

Cross currency swaps form a crucial tool in the management of long-term currency exposures. These agreements to exchange principal and interest payments in different currencies offer protection against anticipated interest rate and currency exchange fluctuations.

5. Merits of Forex Hedging

The Aspect of Better Risk Management

By limiting exposure to risk, hedging strategies provide an enhanced risk management framework for handling market volatility without experiencing significant financial distress.

The Predictability and Stability Factor

Forex hedging strategies lend stability to trading returns and create predictable outcomes. These are notably beneficial while forecasting or budgeting. [Sources: Hedgebook], [GTreasury]

Room for Portfolio Diversification

By spreading the net wider, hedging strategies diversify the portfolio, reducing impact from market movements on individual capital investments.

How Hedging Protects Against Market Volatility

Hedging offers protection against sudden market swings [Source], thereby ensuring more stable trading environments, even in the face of potential market threats.

6. Risks and Limitations of Hedging in Forex Trading

Cost Factor

Hedging strategies often involve expenses like transactional costs and premiums, which can reduce overall financial gains. To maintain profitability, these costs need to be carefully justified and managed. [Sources: GTreasury], [ShareIndia]

Complexity of Strategies

Managing and executing hedging strategies can be a complex task. Expertise in handling these strategies is essential to steer clear of potential risks and maximize benefits.

Potential Downsides

While hedging reduces the chances of losses, it may also limit profit potential and result in reduced net gains as a consequence.

Hedging May Not Always Be Beneficial

In clear market trends, hedging might not always be beneficial as it may unnecessarily curtail profits. It’s crucial to consider market conditions and potential profits before opting for hedging strategies.

7. The Right Time to Implement a Hedging Strategy

Evaluating Market Volatility

Hedging could be considered during fluctuating market conditions impacted by geopolitical tensions or influential economic events. It’s crucial to timely assess these market considerations for strategic decision-making related to hedging.

Existence of Significant Financial Exposure

Hedging strategies become immensely valuable when there’s significant exposure to foreign currencies or substantial trading positions are in play. It’s even more important for international businesses that need to manage the associated risks of global operations. [Sources: Hedgebook], [GTreasury]

Requirement for Steady Cash Flow

Predictable cash flows are crucial to meet financial obligations and plan strategic growth, and hedging immensely serves this purpose. Timely implementation of hedging strategies allows organizations to confidently design growth strategies for future prospects.

Before an Impactful Financial Announcement

Before a major financial announcement that might impact currency values, implementing hedging strategies can secure existing positions against quick market shifts. This ensures the safeguarding of the future growth plan.

8. Instruments and Tools for Successful Hedging

Exploring Futures Contracts

Futures contracts are notable risk management tools. They are standardized agreements to exchange currency at a predetermined rate at a future date, providing certainty and stability in a volatile market.

Venturing into Options – Put and Call

Options, specifically put (right to sell) and call (right to buy), provide flexibility and constraint on risks, facilitating controlled and confident trading.

Understanding Forward Agreements

Forward agreements, while offering flexibility, provide tailored strategies for those who yearn for something specific that isn’t available in standardized contracts. This allows for a more nuanced risk management [Source] approach. [Source: ShareIndia]

Forex Hedging through ETFs and ETNs

ETFs and ETNs facilitate diversifying currency risk and aid in hedging by providing broad access to the market.

9. Real Life Instances of Successful Forex Hedging

Corporate Hedging Case Studies

Real-life examples of successful hedging strategies by multinational conglomerates show how these entities have secured stable revenues and earnings despite currency fluctuations. [Sources: Hedgebook], [GTreasury]

Trader’s Successful Forex Hedging Instances

Individual traders have benefitted immensely by utilizing options to hedge their positions ahead of significant market events.

Lessons Learnt from Successful Hedging

These success stories underline the crucial role of proper timing, strategy, and instrument selection in successful hedging, offering insights into the balance between diversification and protection.

10. Forex Hedging Best Practices

Regular Risk Evaluation

The risk exposure should be periodically assessed, and clear risk management objectives should be set in keeping with these assessments. [Sources: GTreasury], [ShareIndia]

Choosing Proper Hedging Instruments

Choosing appropriate hedging tools that are in line with specific trading goals and risk tolerance levels is important.

Ongoing Strategy Review

The hedging strategies should be constantly reviewed and adjusted to ensure relevance with the changing market conditions.

Training and Continuous Learning

Continuous learning about the market’s movements and the instruments available can foster competent hedging [Source] practices in the long run.

Conclusion

Wrapping Up

Forex hedging is an integral part of managing risks and enhancing trading stability in the unpredictable world of currency markets. Understanding what forex hedging is and its importance can have lasting and beneficial impacts on traders’ financial outcomes.

Final Thoughts

Every trader should consider incorporating forex hedging into their trading plans, as the advantages outweigh the few risks. A strategic and well-considered approach can provide stability and confidence in trading endeavors.

Next Steps

Traders are encouraged to seek professional advice or continue educating themselves about forex hedging to further enhance their trading strategies. Traders need to invest in understanding and applying hedging principles to realize more sustainable and successful long-term trading results.