Novice vs. Experienced: Hedging Strategies for Different Traders

Key Takeaways

- Novice traders may opt for simple hedging techniques with direct hedges.

- Experienced traders can engage in more intricate strategies like imperfect hedging.

- Regular updates on broker guidelines are essential for all traders.

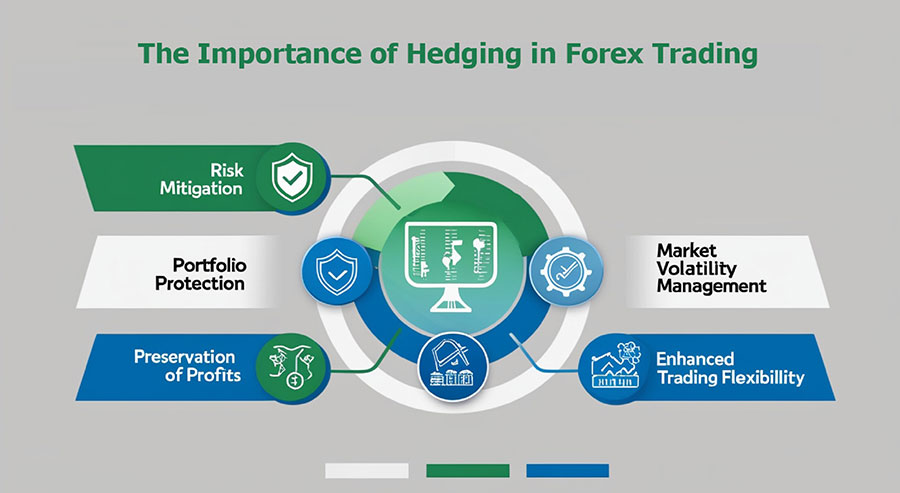

- Hedging can protect trading capital against market volatility.

Table of Contents

Both novice and experienced traders can utilize hedging to manage risk. However, the intricacy varies significantly between these two categories.

For Novice Traders:

For those new to forex trading, understanding the basic concept of hedging can be a significant starting point. A simple hedging strategy could involve opening a direct hedge, i.e., both a long and short position on the same currency pair.

- Benefits: Useful for practicing handling two simultaneous positions and observing their relationship.

- Risks: Limited profits, as gains from one position neutralize losses from the other.

For Experienced Traders:

Seasoned traders may venture into more complex routes. Imperfect hedging and cross-pair hedging are robust examples. These techniques involve employing options or different currency pairs, thus requiring a deep understanding of forex correlations.

- Benefits: Flexibility of strategy, potential for higher profits.

- Risks: More advanced knowledge required, higher risk due to potential asymmetrical losses.

Irrespective of trading experience, adherence to broker guidelines is crucial. Regular learner updates foster navigational ease in the exciting and risky domain of forex trading.

– Source: Babypips – School of Pipsology: Forex Hedging

How to Implement Hedging in Real Life

Once traders decide on a suitable hedging strategy, implementing it requires methodical steps:

- Scenario Understanding: Ascertain why hedging is necessary. Whether it’s a significant economic announcement or an unexpected political development, the usage context determines the strategy’s effectiveness.

- Hedging Strategy Selection: Depending upon the scenario, choose an appropriate hedging strategy. For instance, in face of upcoming major economic announcements, a direct hedge can be effective, while geopolitical events may necessitate cross-pair hedging.

- Execution: This involves opening additional positions in accordance with the chosen strategy.

- Monitoring and Adjustment: Analyze market movements and adjust trading positions accordingly. Hedges may need tweaking or discarding based on shifting circumstances.

Descriptive case studies or examples can aid in conceptualizing the theory into practicality.

– Source: Investopedia – 3 Forex Hedging Techniques

Potential Pitfalls of Hedging

Despite its potential advantages, hedging is not without its pitfalls:

- Incurring Higher Costs: Cost increases due to spreads and commission fees when opening additional positions.

- Managing Multiple Trades: Requires vigilance to keep an eye on all positions, potentially leading to complexity and confusion.

- Limited Profits: Since hedging involves offsetting potential losses, the upside potential is consequently limited.

- Unintended Risk Exposure: If not executed properly or if market conditions change, hedging can expose traders to greater risk.

Detailed knowledge of these potential pitfalls is a must before deciding on a hedging strategy.

– Source: Forex Training Group – Cons of Forex Hedging

Enhance Your Trading Strategies with Hedging

Some traders avoid hedging due to the perceived complexity. However, applying hedging appropriately can enhance your trading strategies significantly:

- Offsetting Trading Losses: Hedging can protect your capital by allowing you to initiate trades that will compensate for losses if your primary positions go against you.

- Gaining Time to Decide: By mitigating losses, hedging can buy you more time to make more informed decisions instead of being forced to close a trade.

- Navigating Market Volatility: Particularly useful when market conditions are unpredictable, hedging offers a means to keep trading and potentially profit even when market directions are uncertain.

Do note that hedging is not about making huge profits; instead, it’s all about protecting your trading capital.

– Source: Babypips – Importance of Forex Hedging

Essential Do’s and Don’ts of Hedging

A successful hedging strategy requires adhering to some crucial do’s and don’ts:

Do’s:

- Do Understand the Basis: Know what you’re doing and why you’re doing it. A deep understanding of forex trading and hedging principles is essential.

- Do Stay Updated: Keep abreast with market trends, news, and broker regulations. Changes in any of these can impact your hedging strategy.

Don’ts:

- Don’t Ignore Your Broker’s Policies: Ignoring terms and conditions may lead to trade cancellations and penalties.

- Don’t Neglect to Monitor Your Trades: Hedging requires constant monitoring and adjustments as market conditions change.

Keeping these points in mind will help traders make the most effective use of hedging.

– Source: EagleFX – Forex Hedging Strategy: Do’s and Don’ts

Frequently Asked Questions

1. What is hedging in forex trading?

Hedging is a risk management strategy used to offset potential losses in a trade by taking an opposite position in a related asset.

2. Is hedging suitable for all traders?

While hedging can benefit many traders, its complexity may not be suitable for novices without proper understanding.

3. Can hedging guarantee profits?

No, hedging does not guarantee profits; it primarily aims to protect against losses.

4. How often should I monitor my hedging positions?

Regular monitoring is essential as market conditions can change rapidly; adjustments may be necessary.

5. Are there any costs associated with hedging?

Yes, hedging can incur additional costs due to spreads and commission fees on multiple positions.